Starting a disclosure and entering amounts

On this page

In NSW, candidates, groups, elected members, political parties and associated entities must disclose political donations made and received and electoral expenditure incurred.

Third-party campaigners must disclose electoral expenditure incurred during the capped expenditure period for an election and political donations received for the purpose of incurring that expenditure.

Electoral expenditure incurred must be disclosed annually for the 12-month reporting period ending 30 June. Political donations must be disclosed every six months for the half-yearly reporting periods ending 31 December and 30 June.

Additionally, in the lead up to a NSW State election, political donations made or received valued at $1,000 or more must be disclosed within 21 days.

Political donors that make reportable political donations must disclose the donations annually for the 12-month reporting period ending 30 June.

In the event that there are no political donations or electoral expenditure to disclose for a specific reporting period, a Nil disclosure form is used to confirm this. Refer to the user guide Submitting a Nil disclosure.

Only the person who is legally responsible for the disclosure is able to sign and submit the disclosure.

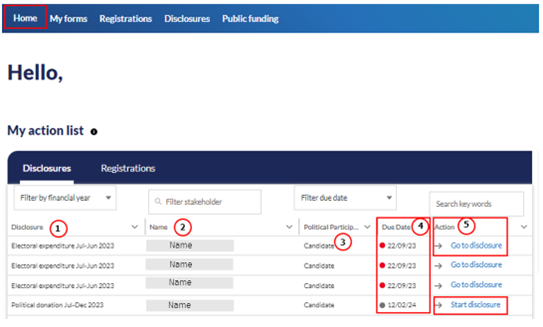

Disclosure action list

The disclosure action list shows all disclosure obligations that are not yet lodged for all disclosure types excluding pre-election disclosures.

1. The disclosure column lists the disclosure obligation type

2. The name lists the person who the disclosure is for

3. The political participant column lists the type of obligation (note: if you are a candidate you may have to submit several obligations if you are also elected as an elected member)

4. The lodgment due date of the disclosure obligation means:

- Red dot: overdue

- Orange dot: due soon

- Grey dot: not yet due

If you have a disclosure listed that is listed with a red dot, it means you have a disclosure overdue, and needs to be submitted.

5. You will be provided with two actions to either ‘start a disclosure’ or ‘go to disclosure’

- if the disclosure has not yet been started you may select ‘start a disclosure’ and either start a Nil disclosure or continue below to ‘creating and entering data into a disclosure’

- 'go to disclosure’ if the disclosure is already in progress and previously started, you may continue entering data (see point 10 below)

Creating and entering data into a disclosure form

1. Login to Funding and Disclosure Online.

2. Go to the ’Disclosures’ tab.

3. Select the ‘Start a disclosure’ quicklink. This quicklink allows you to create a new disclosure form or continue working on a disclosure form that you have already created. Once you create a disclosure form, you can return to it any time before it is submitted to the NSW Electoral Commission.

4. Select the financial year. For disclosure periods prior to FY18/19, email fdc@elections.nsw.gov.au or call 1300 022 011 during business hours.

5. Select the type of disclosure form you want to create or continue working on under ‘Disclosure type’.

6. If you’re responsible for, or have access to enter information for more than one type of political participant, select the political participant type for which you want to create or continue working on a disclosure for. If you’re only responsible for one type of political participant, this will be prepopulated for you.

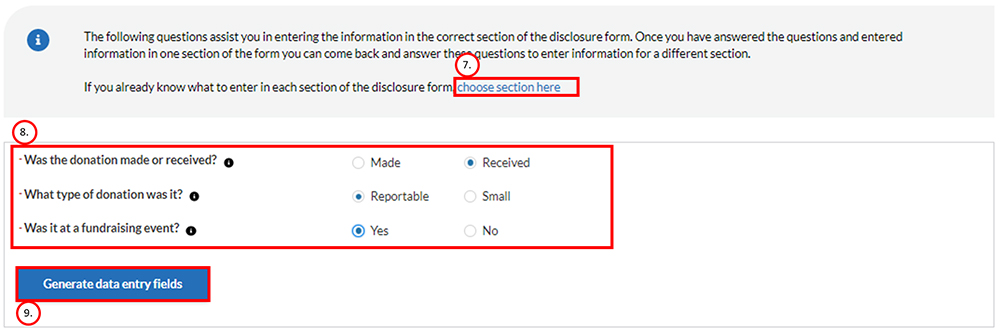

Selecting the correct section of the disclosure form

7. Select the section of the disclosure form you want to enter information for by selecting ‘choose section here’.

8. If you are unsure which section you want to enter information into, use the guiding questions to support you in locating the correct section.

9. Once all guiding questions have been answered, select ‘Generate data entry fields’.

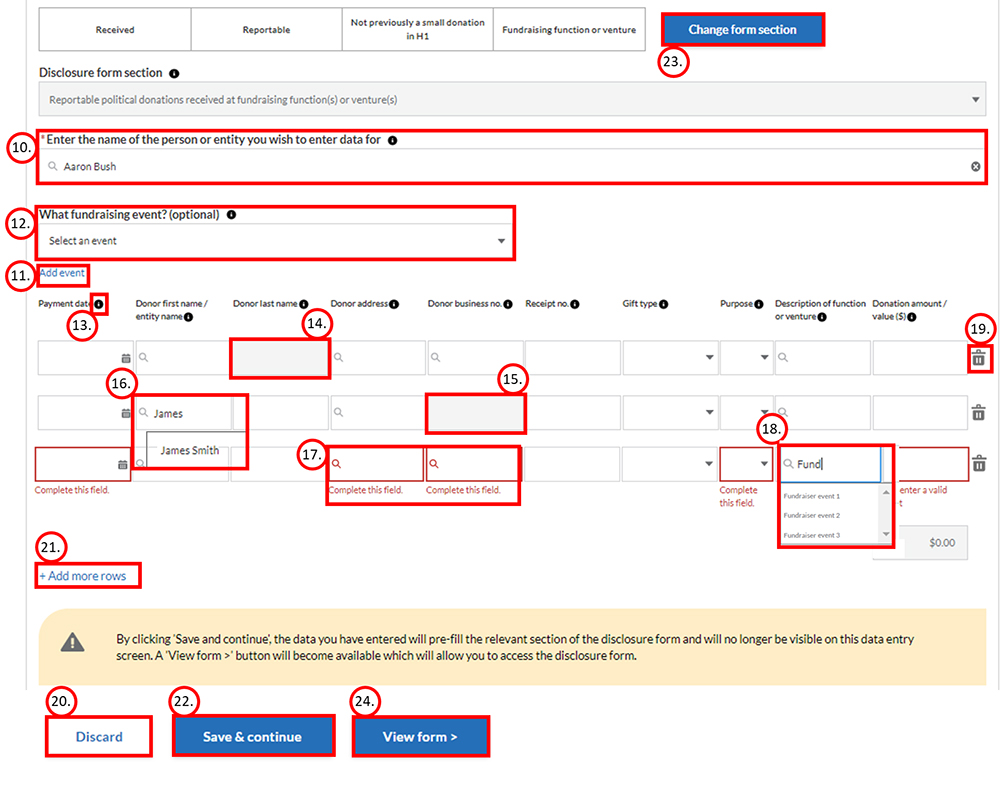

Entering the information to be disclosed

10. If you are responsible for entering information for more than one person or entity, search for that person or entity using ‘Enter the name of the person or entity you wish to enter data for’. If you are only responsible for one person or entity, this field will be autopopulated for you. The information you enter into the data entry fields will flow through to that person or entity’s disclosure form.

11. Create a list of fundraising events that any or all of the political donations relate to by selecting ‘Add event’.

12. Once a fundraising event has been created, you can select this fundraiser from the dropdown to populate the ’Purpose’ and ‘Description of function or venture’ fields

13. Use the tooltips to help you understand what information is required.

14. For political donation(s) made by an entity, you must enter the business name in the ‘Donor first name / entity name’ field and enter the business number in the ‘Donor business no.’ field. You don’t need to enter anything in the ‘Donor last name’ field. To reflect this, once you enter something in the ‘Donor business no.’ field the ‘Donor last name’ field will be disabled.

15. For political donation(s) made by a person, enter the person’s first name, last name and address. You don’t need to enter anything in the ‘Donor business no.’ field. To reflect this, once you enter something in the ‘Donor last name’ field the ‘Donor business no.’ field will be disabled.

16. Search for donors you’ve previously entered information for by using the type ahead function in the ‘Donor first name / entity name’ field. When you select a donor from the list their details that you entered last time will be autopopulated in the relevant fields. You must check that all the donor details are correct as some may have changed since you last disclosed a donation made by that donor.

17. All mandatory fields must be completed before you can save what you have entered.

18. Search for and select a fundraiser in the ‘Description of function or venture’ field if you created a list of fundraisers at step 9. All amounts entered under ‘small donations’ and ‘reportable donations’ received at a fundraising function or venture will be automatically tallied as a gross amount in section A of ‘Donations received at a function or venture’. If you wish to enter the ‘Net’ amount of these donations, this automatic tallying will be removed for you.

19. Delete a row of information by selecting the trash icon.

20. To delete all information you have entered, select ‘Discard’.

21. To add more rows, select ‘+ Add more rows’. A maximum of 50 rows of information can be entered before you will need to to save.

22. Select ‘Save & continue’ to save the information you have entered in the online disclosure form.

23. To enter information into another section or disclosure form select ‘Change form section’.

24. Once successfully saved, you can view the disclosure form by selecting ‘View form’. You can continue to enter, edit or delete information in the form.

25. In progress or draft forms are stored within ‘Disclosures’ and under the “continue or view disclosures” quicklink.

25. In progress or draft forms are stored within ‘Disclosures’ and under the “continue or view disclosures” quicklink.

26. Refer to the user guide “How to complete and submit a disclosure form” for steps to complete, sign and submit the form online.

Note: A disclosure form is not validly lodged with the NSW Electoral Commission until you have added your electronic signature and submitted the form during the lodgement period.